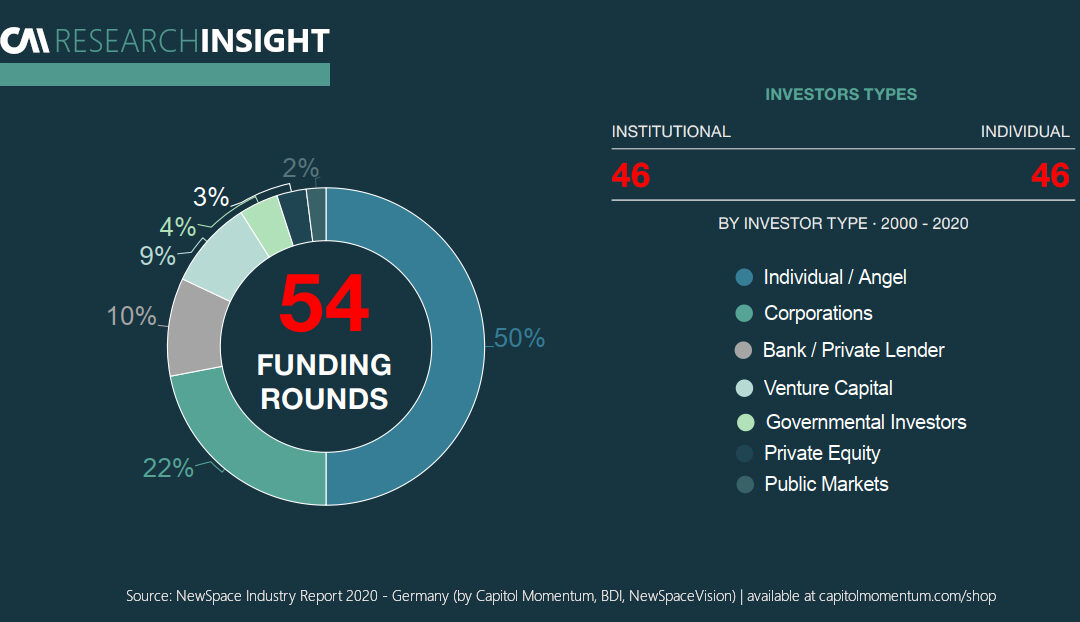

The analysis of the capital providers of the German NewSpace companies throughout the past two decades has revealed that funding sources were quite diverse over the course of 54 funding rounds. Most companies are financed by Individuals such as Angel Investors, Friends & Family or the Founders themselves (50%). The remaining half comprises of institutional investors.

Interestingly, 22% of these institutionals classify as Corporations. This category includes parent-subsidiary relationships or majority stakes in NewSpace firms as well as investments from external corporations in NewSpace ventures. Our data indicated that 10% of the businesses obtained debt financing provided by Banks and/or Private Lenders. Only 9% of German NewSpace is Venture Capital-backed. 4% of equity funding was provided by public governmental investors and only 2% of the businesses are financed through Public Offering.

Looking at 2019 and 2020, the German NewSpace landscape has seen a variety of striking funding deals. Equity investments have increased not only due to excess liquidity but also because of the continuing low interest rate environment driving venture capital in the NewSpace economy. In that time period, Venture Capital Top Deal Investment in German NewSpace businesses nearly doubled to €308m in 2020.

With economic conditions nearly remaining the same for the first half year of 2021, an increased number of NewSpace startups in recent years and more and more VC’s adding NewSpace to their portfolio, we cannot wait for German NewSpace interim investment results 2021.

Results of our research on the German NewSpace market are published in the NewSpace Industry Report for Germany 2020 in cooperation with BDI – Bundesverband der Deutschen Industrie e.V. and NewSpaceVision.

Disclaimer

Despite careful and thorough investigation of facts, figures and data analysis applied, Capitol Momentum does not claim to have complete information, nor do we imply to have access to private or confidential information on any company, project or individual listed or identified. Capitol Momentum does not accept responsibility for any business, investment or partnership decision resulting from this report.

Source: Capitol Momentum

Image: Released 21/7/2021

Note: This work is licensed under the Creative Commons Attribution NoDerivatives 4.0 International License. This means content cannot be altered from its original form and must include Capitol Momentum. View a copy of this license here.