When we at Capitol Momentum first started mapping the German NewSpace ecosystem within the first German NewSpace Industry Report 2020 – Germany, which was a joint project with the BDI and NewSpaceVision, we noticed a spike in German SpaceTech business startups in the year 2018 compared to prior years. That very year, today well-known NewSpace companies like Morpheus, HyImpulse, RFA, Isar Aerospace LiveEO, Yuri, OroraTech, OKAPI or agriBORA were established. These companies have in common, that they were funded and scaled by equity investments through venture capital, angel and corporate investors.

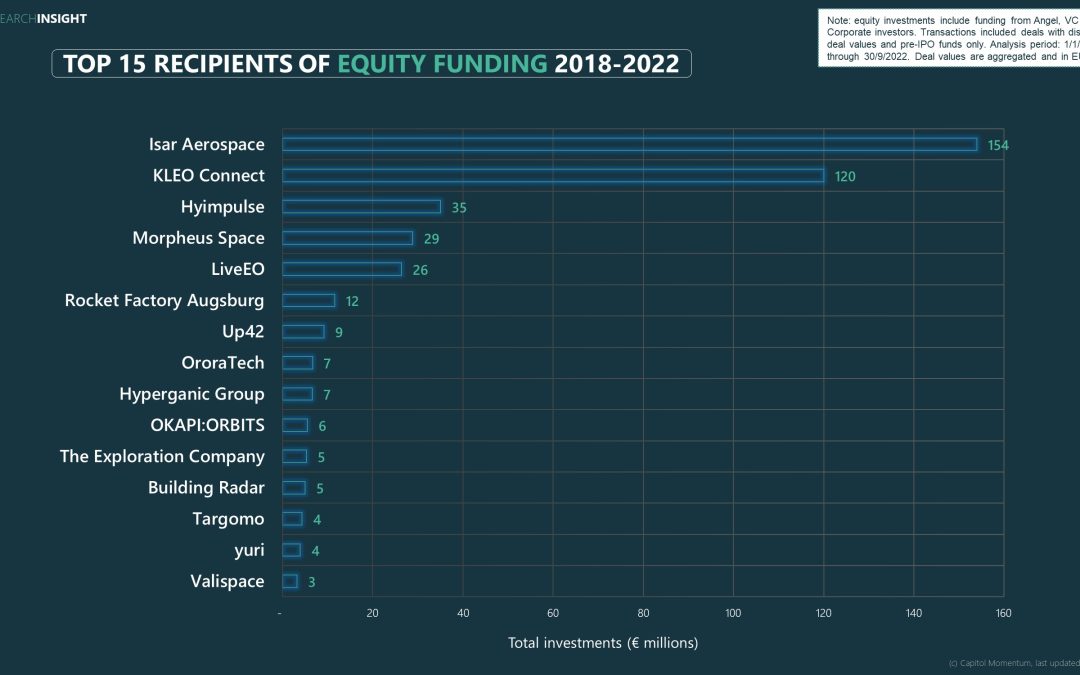

5 years in, at the end of 2022, we were curious to have a look at the total combined equity funding that German NewSpace ventures were able to secure. This chart shows the Top 15 recipients of equity funding from 2018-2022 with an estimated total disclosed deal volume of about €425 million.

Isar Aerospace received an estimated €154 million in equity investment between 2018-2022. Investors include a variety of high-profile backers such as the VC’s Earlybird Venture Capital and Vsquared Ventures, corporates like Airbus Ventures and Porsche and angel investors. Based on information from Isar’s most recent funding round, we estimate the microlauncher’s valuation at €580 million. KLEO connect, a broadband satellite constellation operator, received an estimated €120 million in seed round funding in 2019, largely supported by corporate investment activity from Shanghai Spacecom Satellite Technology. Morpheus Space, an electric propulsion system spin-off from TU Dresden, raised an estimated total of €29 million in 3 venture rounds from investors such as Techstars, Airbus Ventures, In-Q-Tel and Alpine Space Ventures. At the other end of the value chain, lighter software-based business models in the downstream domain have been successfully raising equity just as well. LiveEO, the EO data analytics startup from Berlin, raised a considerable amount of venture capital within the previous five years. The startup received a combined total of €26 million from angels and VC’s.

Download the TOP 15 info graphic for free in high quality

Note: equity investments include funding from Angel, VC and Corporate investors. Transactions included deals with disclosed deal values and pre-IPO funds only. Analysis period: 1/1/2018 through 30/9/2022. Deal values are aggregated and in EUR. Despite careful investigation of facts, Capitol Momentum does not claim to have complete information, nor do we imply to have access to confidential information on any company identified. Sources include Company media outlets, financial statements, public registers, investment databases, news articles.

Earlier this year, we published a 2021 German NewSpace Investment Report that provided details on private investments in the ecosystem. 2021 was another record year for investment in the German NewSpace landscape, with 23 total deals closed (incl. deals with disclosed and undisclosed deal value) across all space technology stacks in unique German NewSpace companies. With a disclosed deal volume of €399m in 2021, there has now been almost a billion euros (€881m) of equity investment in the German NewSpace economy over the past 3 years. While NewSpace momentum set all-time records for space investments in Germany in 2021, we are curious to see if growth (+229% total counts YoY in 2021) will continue for 2022.

If you are interested in company-specific analysis of German NewSpace companies, check out our CM Quicktakes series. A tracker of our publications can be found here.

(c) Capitol Momentum

Image: Released 10/8/2022

Note: This work is licensed under the Creative Commons Attribution NoDerivatives 4.0 International License. This means content cannot be altered from its original form and must include Capitol Momentum. View a copy of this license here.